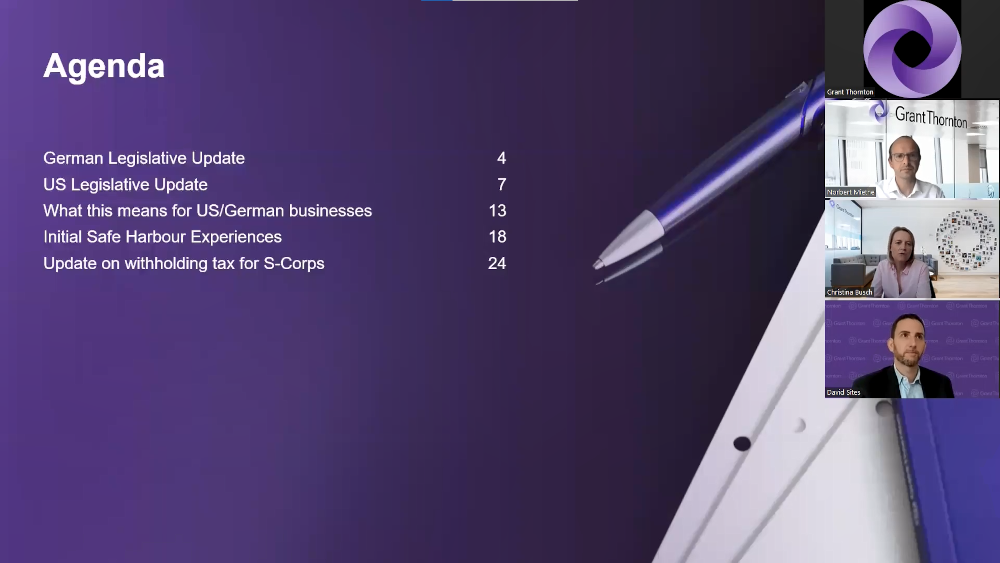

On June 15, 2023, Grant Thornton AG and AmCham Germany hosted an Expert Webinar on "Current Developments in Global Minimum Taxation Legislation: Pillar 2 versus Book-Minimum-Tax and GILTI – How German & U.S. Companies Are Affected and Can Act Now."

Mrs. Christina Busch, Partner and Head of International Tax, Grant Thornton Germany, provided a captivated audience of AmCham Germany members and other interested participants with an update on the status of the implementation of Pillar 2 in Germany. In March 2023, the German Federal Ministry of Finance published a draft law including explanatory comments.

In her presentation, Mrs. Busch highlighted how numerous procedural aspects remain open in the German discussion draft, including how to regulate potential disputes between countries regarding implementation and technical understanding of Pillar 2. She stressed that international companies should start setting up corresponding processes and start calculating (transitional) safe harbors. Germany is obliged to implement the Pillar 2 EU directive into national law by the end of 2023, with first-time application beginning in 2024.

Mr. David Sites, International Tax Partner, Grant Thornton LLP U.S., shared insightful information on the status of discussions that are currently going on in the United States regarding Pillar 2, and impacts on current U.S. taxation such as GILTI. He delved into prospects for American adoption of Pillar 2, stressing that the prospects for Pillar 2 legislation in the U.S. could change depending on the outcome of the next major American election.

In the final section of the webinar, Mr. Norbert Miethe, Partner International Tax, Grant Thornton Germany, focused on transitional safe harbor regulations of Pillar 2. He also shared his insights on withholding tax for S-Corps with U.S. and German perspectives. He emphasized that we should be closely monitoring developments in the legislative process along with U.S. elections in 2024.

Grant Thornton LLP provides consulting services. The company offers accounting and business advisory services, covering areas such as audits, taxes, corporate finance, information technology, litigation, strategy, and more.

A presentation of the webinar can be found here.

Contact to speakers: